Planning for retirement is one of the most important steps you can take to secure long-term financial stability and peace of mind. Smart retirement planning isn’t just about saving money today; it’s about building a financial strategy that allows you to enjoy your retirement years with comfort, freedom, and zero stress.

This guide will walk you through the essentials of setting clear retirement goals, reviewing your current financial situation, and organizing your savings and expenses in a smart, practical way. You’ll also learn how to plan for future income sources, create a withdrawal strategy, and make sure you have steady financial support for the lifestyle you want during retirement.

The Basics of Retirement Planning

Understanding the basics of retirement planning is essential for anyone who wants a secure and financially comfortable future. Retirement planning doesn’t just reduce stress; it ensures you have the resources you need to live your post-retirement years exactly the way you envision. A solid retirement plan acts like a roadmap that guides your long-term goals and adjusts over time as your life changes.

Whether you're aiming to pay off your home loan, travel the world, or secure your children’s future, your retirement plan should be realistic and achievable.

When planning for retirement, make sure you consider:

- Financial stability.

- Medical needs and long-term healthcare.

- Housing and lifestyle preferences.

- Daily living expenses.

- Future care requirements.

- Family responsibilities and your children’s needs.

Even if it feels like a lot to think about, a comprehensive approach gives you more control and financial confidence. Smart planning helps you manage your resources wisely and enjoy a peaceful, worry-free retirement. It’s not just about saving a certain amount, t’s about creating a future you love living in.

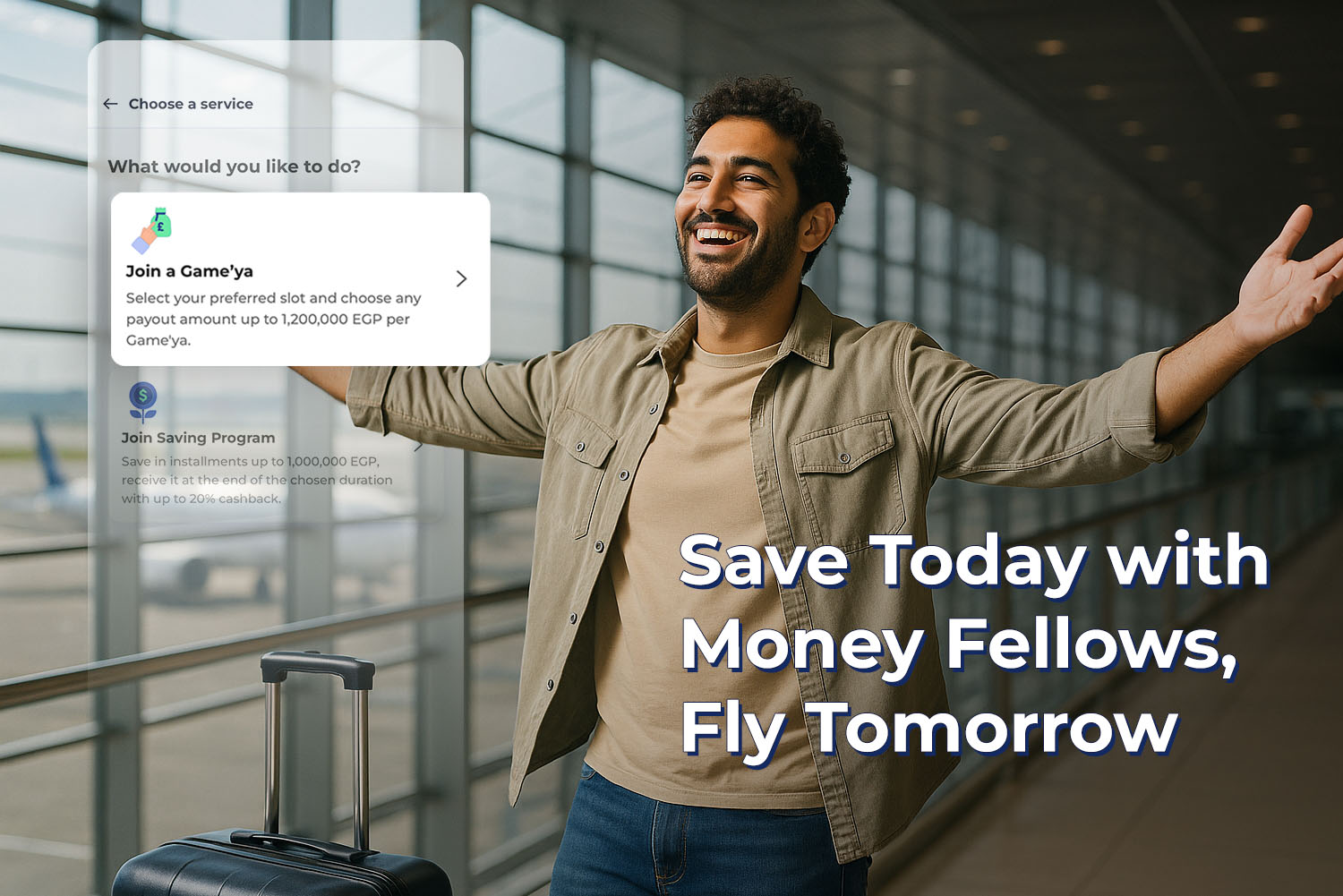

And to make your planning easier and more organized, download Money Fellows. The app helps you save steadily, reach financial goals, and build real financial stability for your retirement years.

If you want to dive deeper into retirement planning, check out this article: How to Secure Your Future After Retirement?

6 Essential Retirement Planning Steps for a Comfortable Retirement

Now let’s break down the practical steps you need to take to prepare for a smooth, stress-free retirement. With these six steps, you’ll learn how to set your goals, manage your expenses, and secure your financial future:

1. Set Clear Retirement Goals

Start by visualizing the lifestyle you want after retirement, your daily routine, activities you enjoy, and the place you want to live. Whether you dream of traveling or living quietly in a smaller home, having a clear picture helps guide your financial decisions.

Break your long-term retirement vision into smaller, achievable milestones. Setting yearly or five-year goals can make tracking progress easier and help you adjust your strategy when needed.

Ask yourself:

- What age do I want to retire?

- What lifestyle do I want after retirement?

- What will be my main sources of retirement income?

2. Assess Your Current Financial Situation

Review your current financial standing by looking at your savings, investments, debts, and assets. Understanding your financial baseline will help you calculate how much you need to save and invest to enjoy a comfortable retirement.

At this stage, review your monthly income and expenses and calculate your net worth by listing all your assets and liabilities.