Don’t make this mistake: starting married life in debt.

If you’re getting ready to furnish your home, you already know prices are skyrocketing. What used to cost pennies now costs a fortune, from fridges and stoves to kitchenware and furniture, everything is two or three times more expensive than before.

Under this pressure, many people fall into the trap of installment plans with high interest rates, just to get things done quickly. But what happens next? You start your married life buried in debt, worrying every month about how you’ll manage your finances.

So, what’s the smarter solution? Just one word: Money Fellows Circles. Here’s why it works.

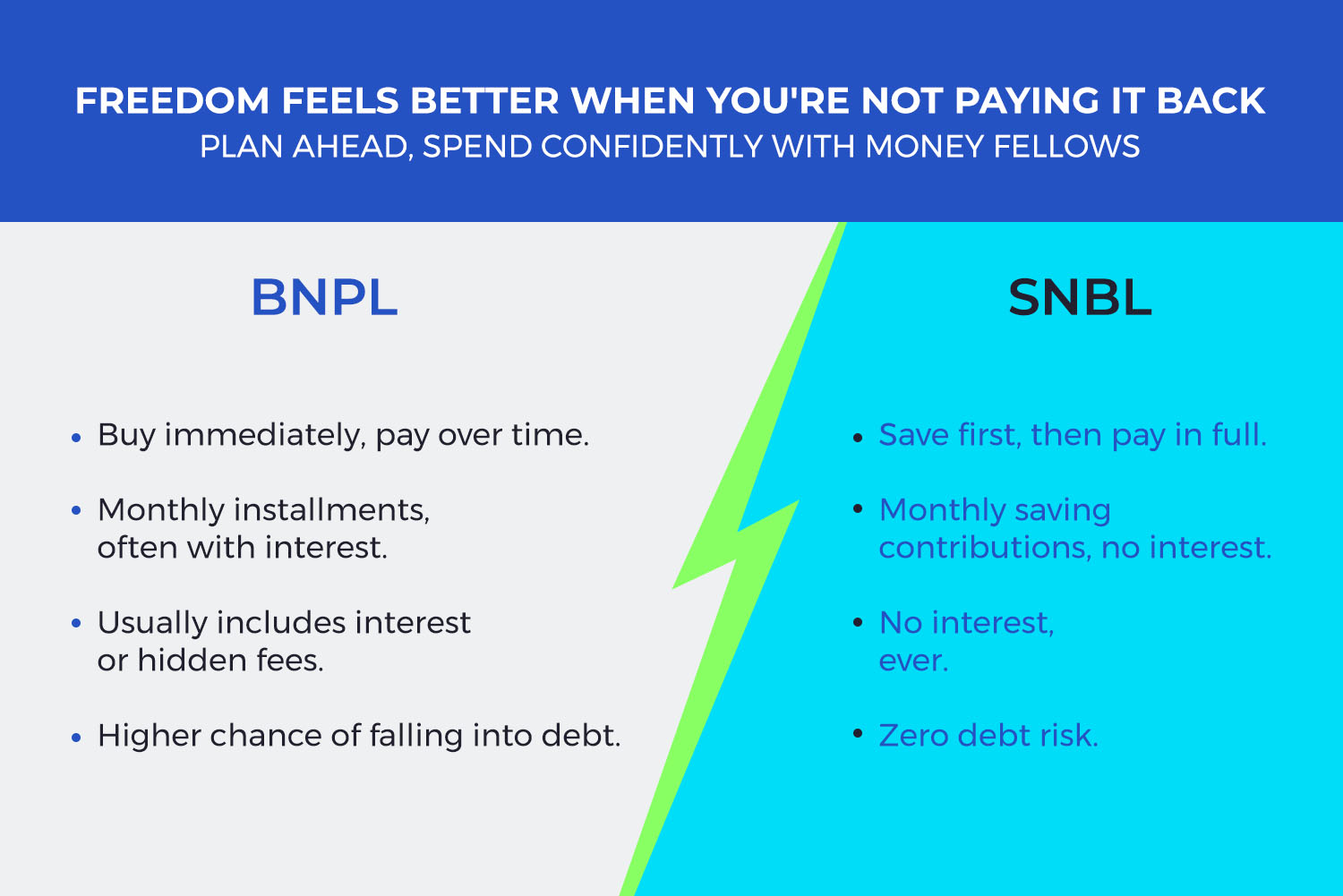

Why do money circles beat installment every time?

Sure, buy now, pay later (BNPL) might sound convenient. You get what you need quickly, and it feels like a temporary solution. But here’s the truth: Installments come at a heavy cost, literally:

- You pay more because of high interest rates

- You're stuck with long-term monthly payments

- You carry the constant stress of being in debt

Now imagine a smarter way, a money circle (game'ya) that gives you the money you need, when you need it, with:

- No interest

- No complicated conditions

- Full flexibility

It’s the same money you save, just received at the right time to serve your goal.

Ditch the stress of debt, download Money Fellows, and start saving for your marriage now! Choose your payout time and get the cash when it suits you.

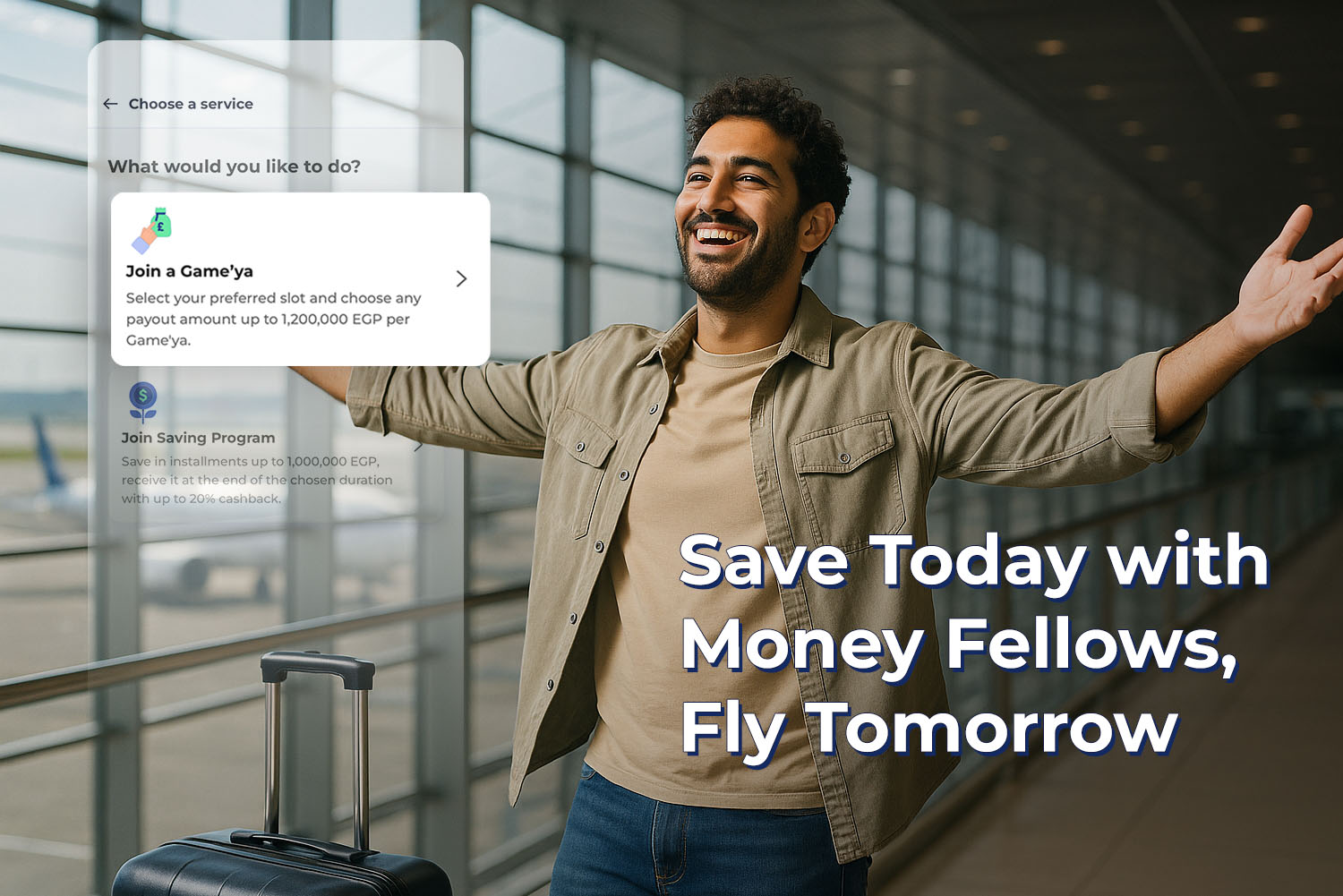

Start here: join your circle directly from your phone

Forget chasing friends for a traditional circle or falling into long-term debt. With Money Fellows app, you can join a digital game’ya directly from your phone, safely, quickly, and stress-free.

Money Fellows is a licensed digital saving platform, regulated by the Central Bank of Egypt’s sandbox and in partnership with Banque Misr. It’s secure, easy to use, and helps you reach your goals without debt.

Whether you’re buying home appliances, furnishing or renovating, paying your apartment down payment

You can do it all without debt or interest, through a circle that suits your lifestyle.