We all want or need to change our phones. And in a world where every day brings a new model, better cameras, and higher specs, it’s normal to think: “Why not use installments?”

But the truth is: Installments look easy at the start, but often become heavier, more stressful, and much more expensive in the end. That’s why more people in Egypt are now looking for ways to buy a new phone comfortably, without commitments, and without feeling like half their salary disappears into monthly installment payments with high interest rates.

This shift is what pushed many people toward a smarter buying strategy: Plan better… save smarter… and buy without stress.

Yes, we’re talking about Save Now, Buy Later the method that has become a key part of smart shopping in 2025.

Let’s break it down simply.

What Are Installment Plans, and How Do They Work?

Installment plans let you split the price of your new phone across several months instead of paying the full amount upfront. Usually, it works like this:

- You pick the phone and the seller.

- You compare the cash price vs installment price.

- You choose your repayment period (6 months, 12 months, 24 months…).

- You submit your info depending on the provider.

- You take the phone and pay your first installment or down payment.

Sounds easy… but that’s just the surface!

Why Installments Aren’t Always the Best Choice?

We won’t say installments are “bad”, but here’s why more people are moving away from them:

1. Heavy Commitment

Even if the monthly installment looks small, the idea of being forced to pay a fixed amount every month, usually with high interest, creates real financial pressure.

And if anything unexpected happens? The whole plan turns into stress.

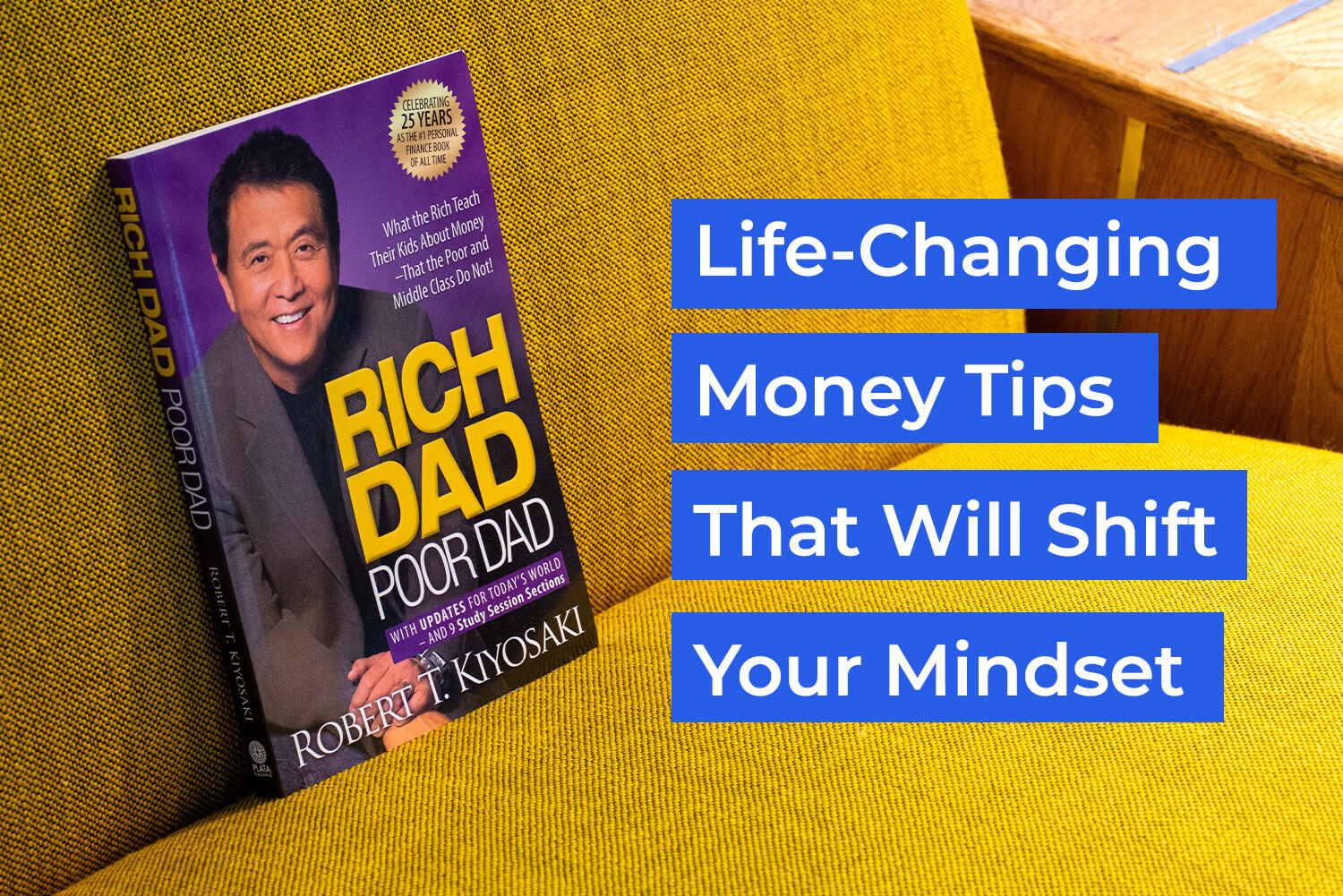

2. You Pay More Than the Phone’s Price

If the phone costs 30,000 EGP, you might think you’ll pay 30,000.

But with interest, extra fees, and long repayment periods, you often end up paying way more than the original price.

3. You Overshoot Your Budget

Installments make you think: “Why not upgrade? It’s only a small difference per month.”

But that “small difference” turns into double the cost over time, going far beyond what you originally planned to spend.

What’s the Smart Alternative to Installments?

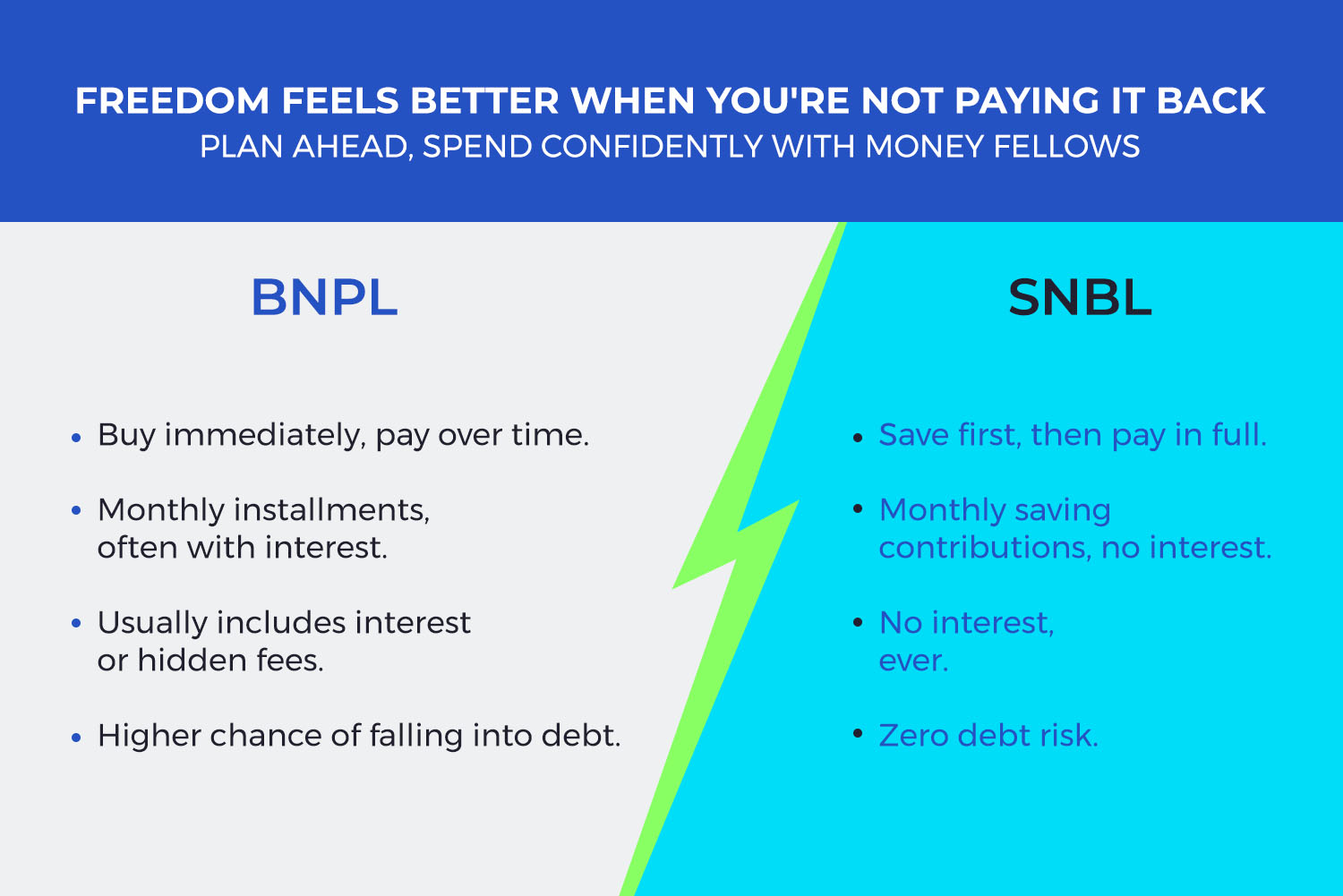

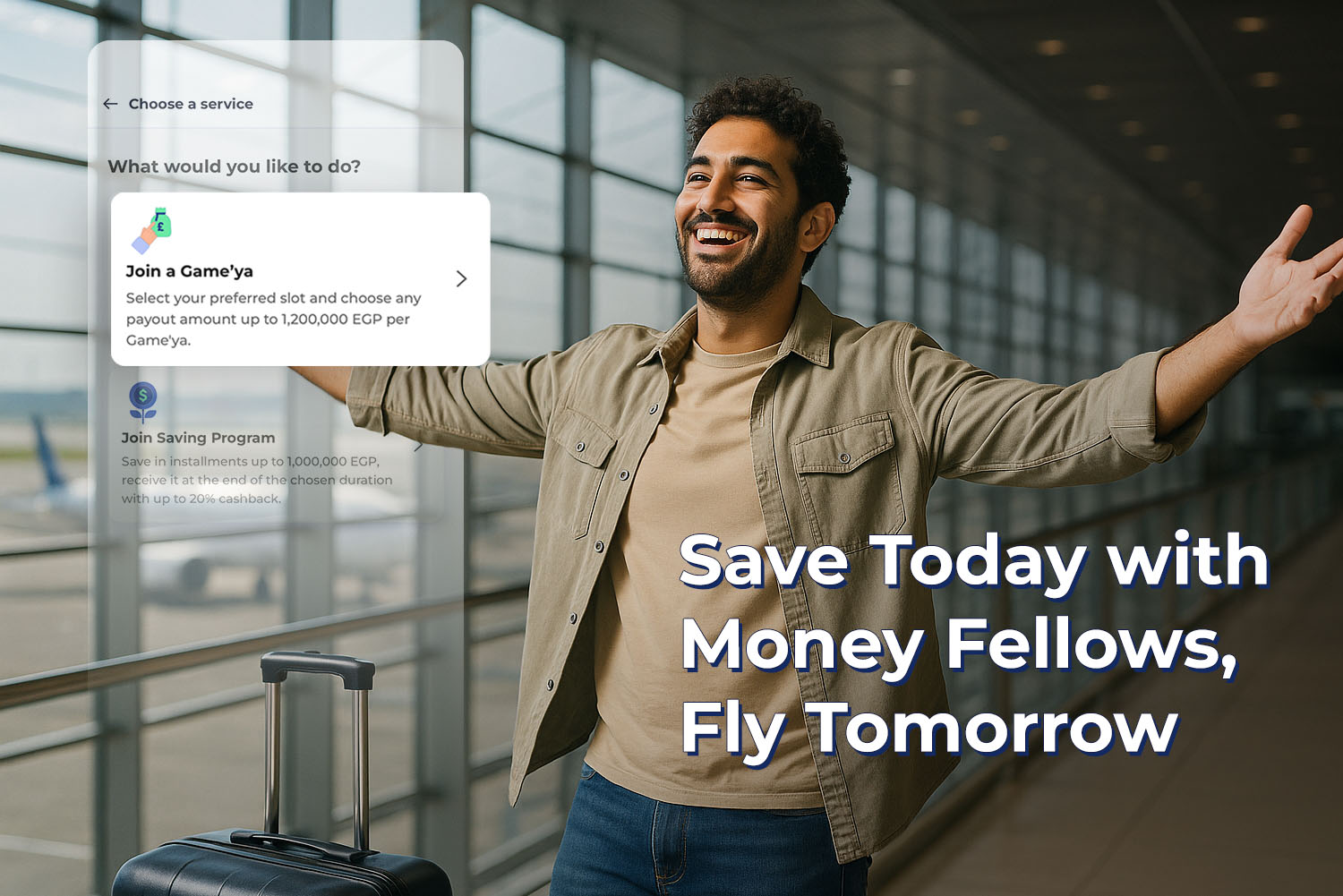

With people struggling with interest, long commitments, and high upfront fees, the smarter alternative today is: Save Now, Buy Later (SNBL). That’s exactly why many people are turning to saving circles, especially digital, licensed, organized ROSCAs like Money Fellows.

Because SNBL flips the entire concept:

- Instead of paying extra, you pay nothing more.

- Instead of monthly interest, you get cashback or value returns.

- Instead of watching your money disappear, your savings grow, and you take them in cash at the end.

If you haven’t downloaded the app yet, get it now and start smart saving without high-interest installments.