If you scroll through social media these days and see prices rising, living costs increasing, and the value of money dropping, it’s normal to wonder: “How am I supposed to keep up? And how do I protect my savings when everything keeps getting more expensive?”

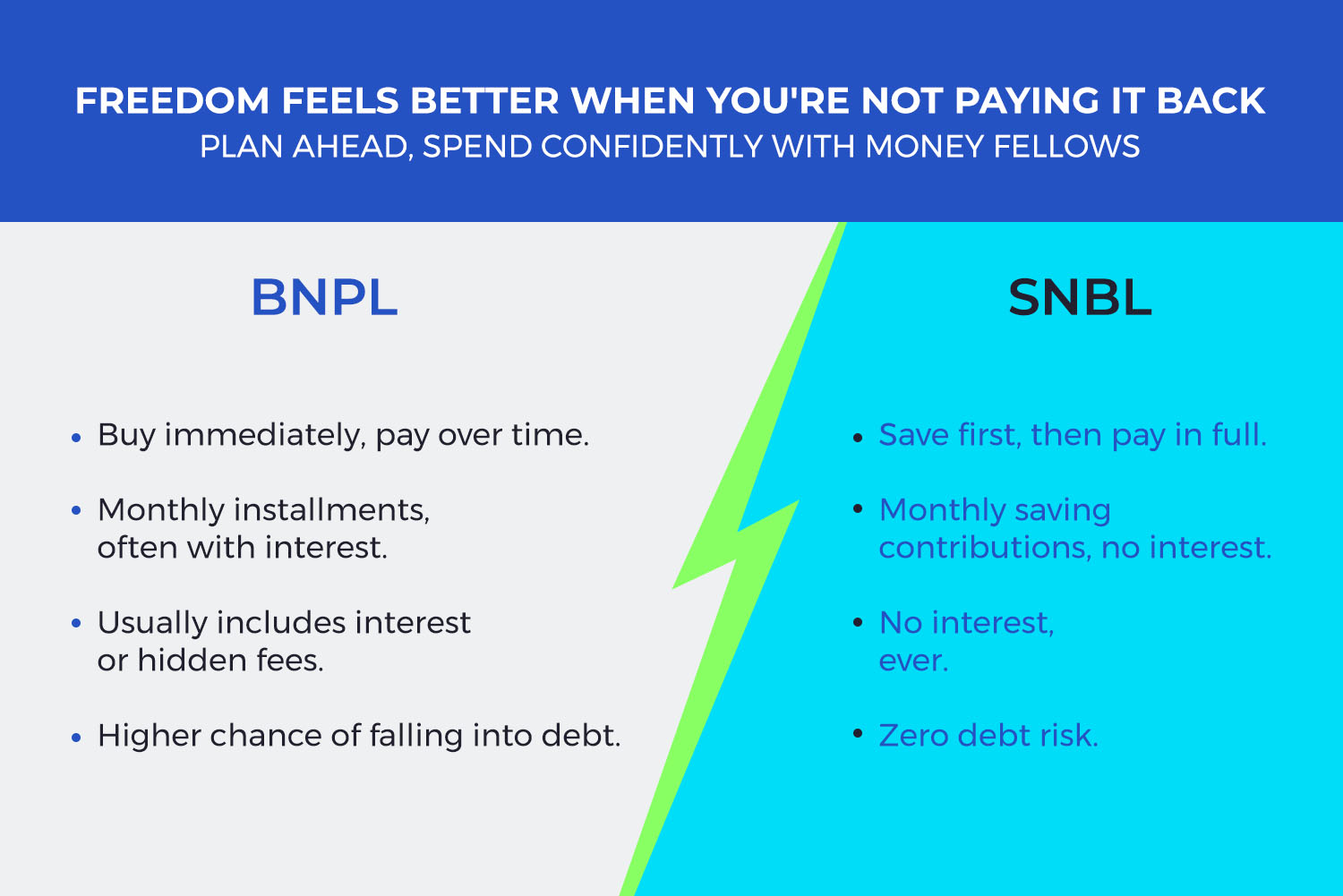

With inflation, currency fluctuations, and the high cost of living in Egypt, smart saving has become more essential than ever. More people are now searching for safe ways to save money without falling into high-interest loans or long installment plans.

And this brings us to gold, a traditional investment, yes, but one of the smartest and safest options during economic uncertainty.

Why? Because gold holds its value, it often increases over time and carries significantly lower risk.

Gold in Times of Crisis: A Safe Haven Throughout History

Gold has always been the safest investment during global and local economic crises. From the 2008 financial crisis to the COVID-19 pandemic, to Egypt’s current inflation wave, gold prices kept rising while currencies lost purchasing power.

Every major financial crisis shows the same trend: people rush to buy gold to protect their money. Not just because gold is “valuable,” but because it’s trusted. It’s a reliable store of wealth when currencies become unstable.

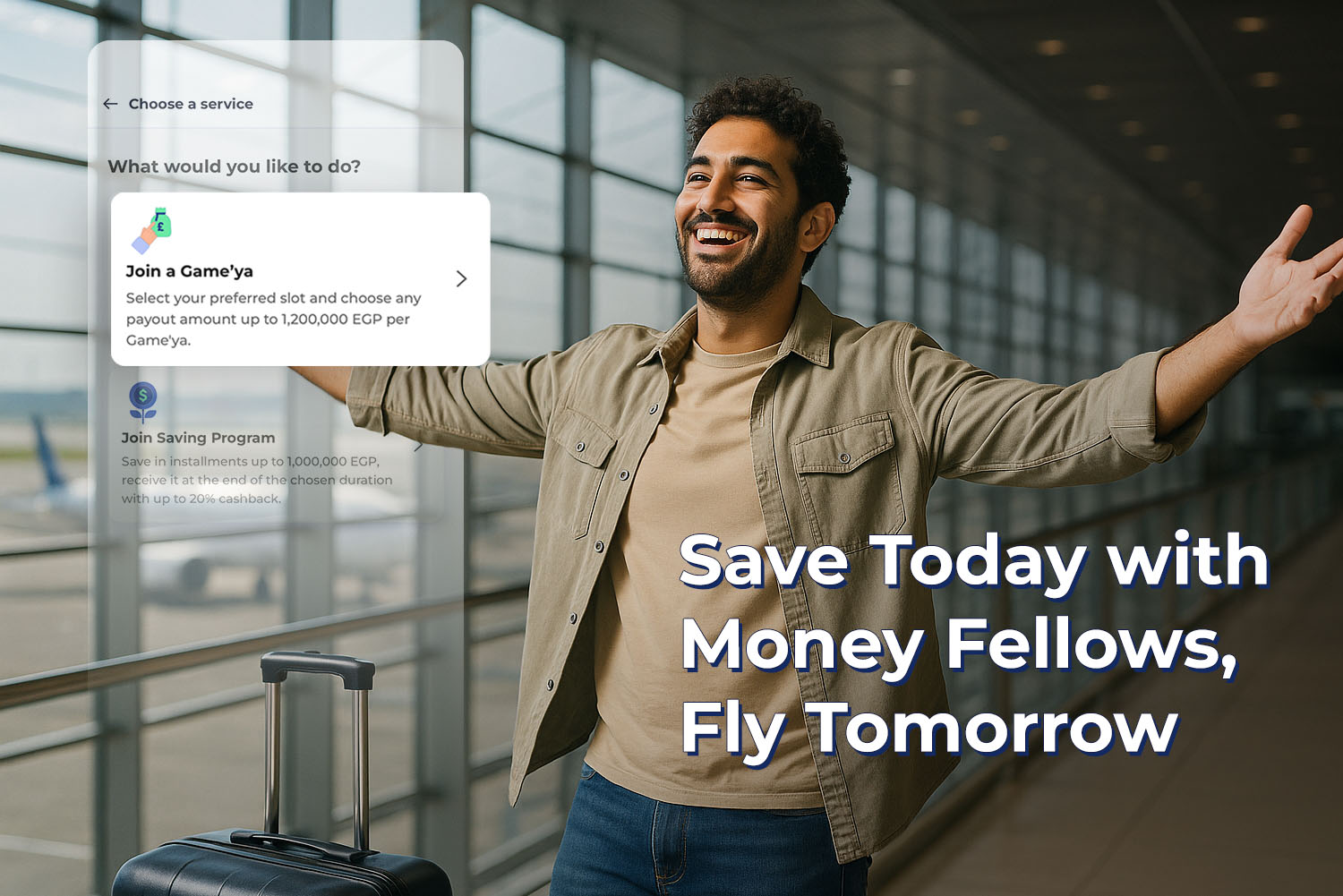

Those who understood this early were able to protect, and even grow, their savings. And now, you can do the same by joining a Gold Circle on Money Fellows.