At Money Fellows, we’re proud to announce our latest fund, securing a $13 million investment in 2025, a significant milestone in our mission to revolutionize digital financial services across Africa.

This funding round supports our expansion to Morocco. With total funding now reaching $60 million since our 2017 launch, Money Fellows continues to lead the way in fintech funding in Egypt and the region.

The funding round was co-led by Al Mada Ventures and DPI Venture Capital, with additional participation from renowned investors Partech and CommerzVentures.Their confidence in our vision reflects the growing demand for innovative financial solutions in emerging markets.

Purpose of the Investment

This funding will fuel several key initiatives as we continue to scale:

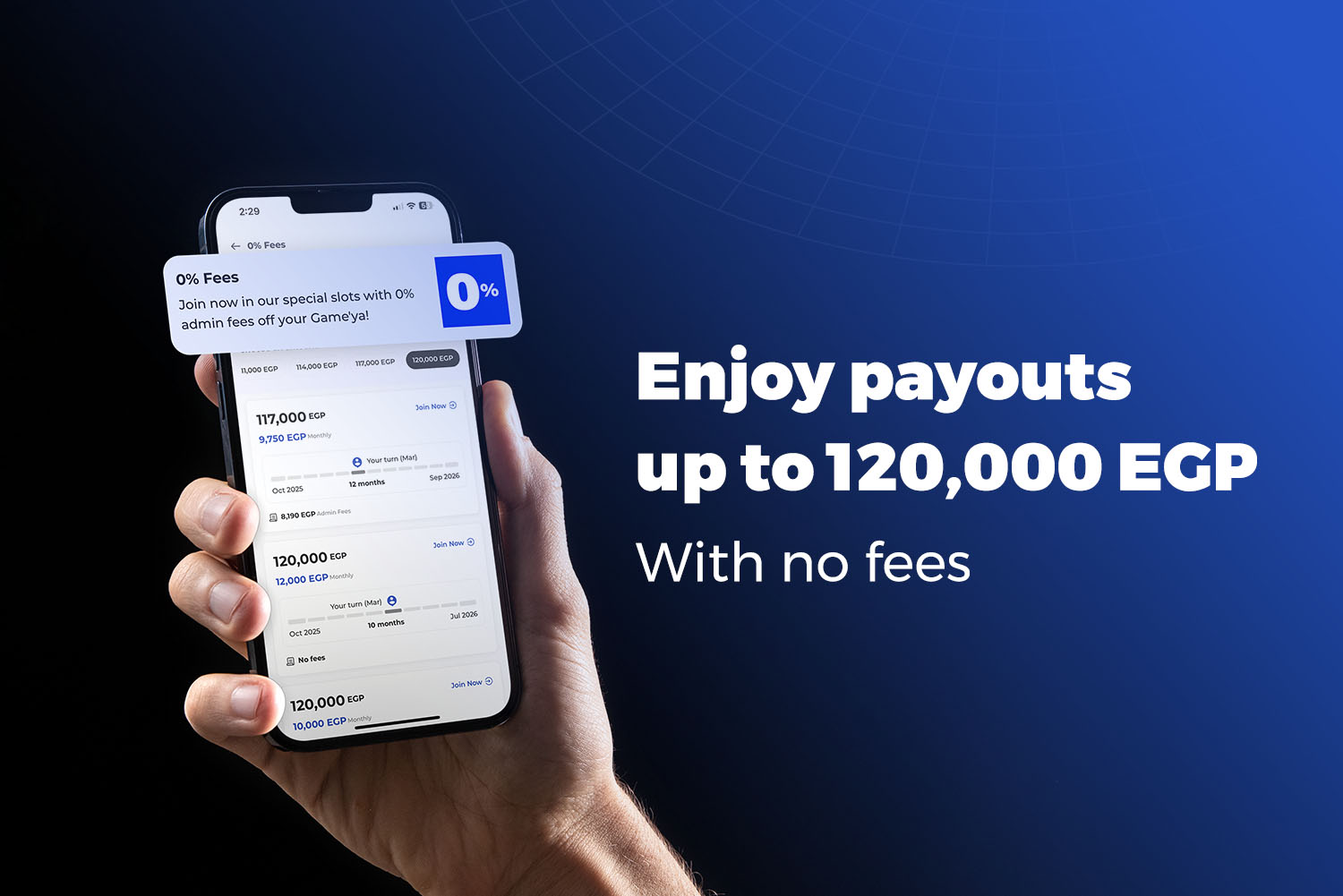

- Enhancing Money Fellows App to deliver a smarter, faster, and more user-friendly digital experience for our 8.5 million+ users across Egypt and beyond.

- Expanding into new regional markets, focusing strongly on North Africa, particularly Morocco, as a gateway for broader MENA growth.

- Growing our internal team to support our rapid expansion and ensure best-in-class service to our growing user base.

Our goal is to digitize traditional savings and lending methods, offering secure and accessible financial services that empower underserved communities. At Money Fellows, we're committed to driving financial inclusion by making innovative fintech solutions available to millions across Africa.

A Word from the CEO

Ahmed Wadi, Founder and CEO of Money Fellows, shared:

“Money Fellows has become an integral part of Africa’s fintech landscape by combining the power of traditional group savings with cutting-edge digital solutions. This investment is a clear vote of confidence in our potential and our mission to empower people — especially in financially underserved regions — to save, invest, and access credit in smarter, more affordable ways.”