Who doesn’t dream of traveling? Everyone has at least one destination that feels like their dream trip. For our generation, travel is no longer just a luxury; it has become one of the most important financial goals we strive to achieve.

Some dream of a quick getaway to the beach to escape work stress, others want a tour across Europe to explore new cultures, while some aim to travel abroad for education or professional courses. Travel is a shared dream, but the real question is: how do you make it happen without draining your finances or falling into years of debt with high interest?

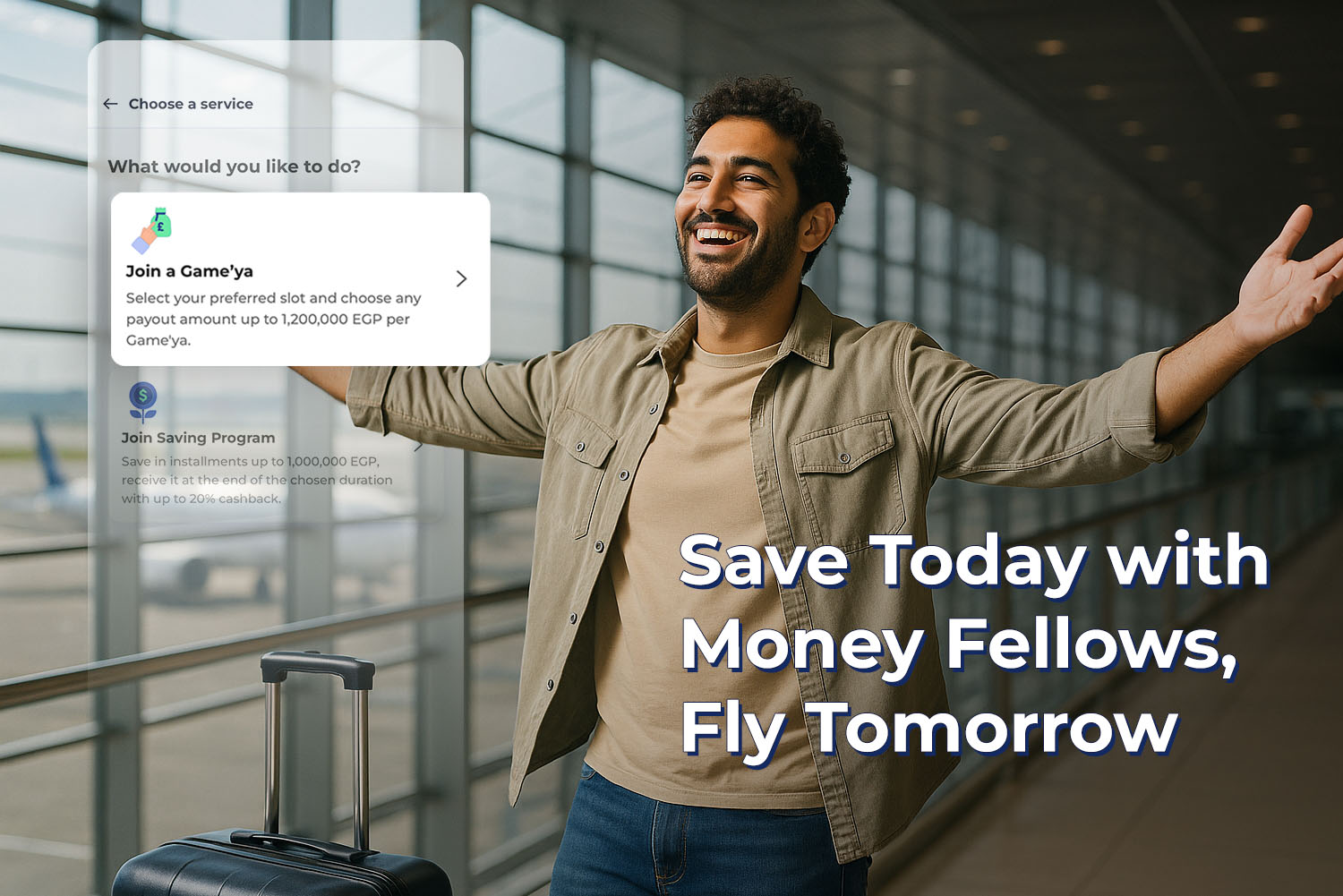

In this article, we’ll show you why smart travel planning matters and how you can reach your travel goals debt-free with Money Fellows Travel Circles.

Why Smart Travel Planning Matters?

Travel isn’t just about booking a flight and a hotel. Behind every trip, there are multiple costs, visa fees, local transportation, food, activities, and shopping. With inflation and rising prices, delaying your trip usually makes it even more expensive.

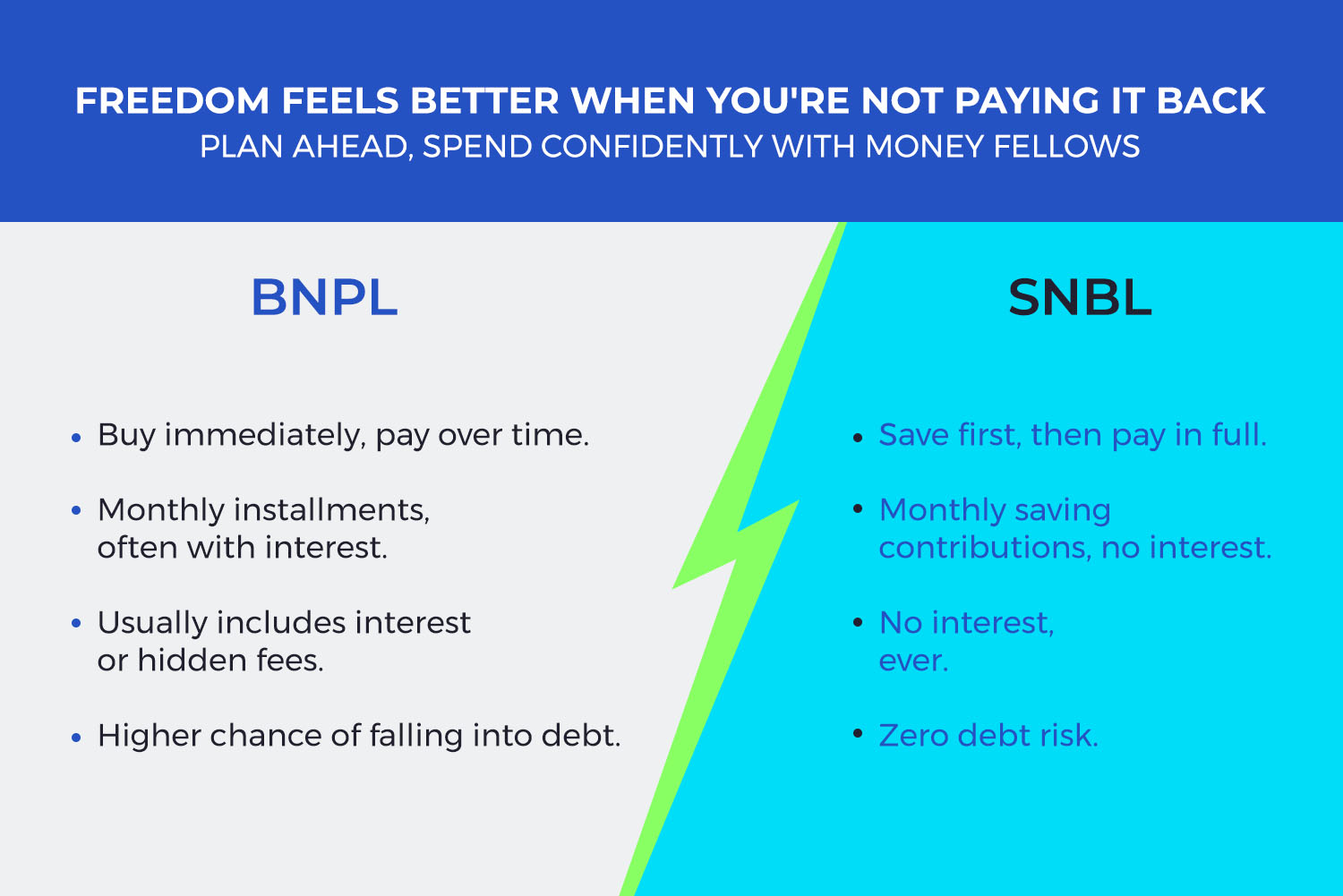

Many people turn to credit cards or personal loans to fund their travels. At first, it feels easy, you enjoy your trip now and pay later. But the truth is, high interest rates and hidden fees turn that dream trip into a long-term financial burden.

And now you can plan your next trip easily and save more with Money Fellows’ offers on zero-fee slots. Subscribe here.

The Real Cost of Traveling on Debt

If you rely on a credit card for your trip, you may think you’re spending 50,000 EGP. But with interest and fees, the final cost could reach 70,000 or even 80,000 EGP.

That means your memories of the trip will be tied to monthly installments and financial stress long after you’re back home, making the negatives outweigh the joy of traveling.