Retirement planning is one of the most important financial decisions anyone will make in their lifetime. While you're working, it’s essential to save consistently to prepare for life after work and to meet specific goals at various stages of your life. According to the National Institute of Retirement Security, over 60% of households led by individuals aged 55-64 have less than their annual income saved for retirement.

With changing economic conditions and rising living costs, securing a stable income source for life after work has become more crucial than ever. How can you ensure financial security and maintain a comfortable lifestyle after retiring? In this article, we’ll break down everything you need to know about retirement and planning for it in a straightforward way.

What is a Retirement Pension?

A retirement pension is a fixed monthly income that you receive once you reach retirement age, which varies depending on your country’s regulations. For example, in Egypt, the retirement age is 60. The purpose of a pension is to provide financial security after you stop working, whether you’ve been employed in the public sector or the private sector.

Why Is It Important to Start Retirement Planning Early?

As mentioned earlier, planning for retirement and building a savings plan is vital. Here are some key reasons why you should start as early as possible:

1- The Power of Compound Interest

Compound interest is entirely time-dependent. The earlier you start saving, the more time your savings have to grow. Compound interest helps your money grow significantly because it earns interest on both your initial savings and any accumulated interest. For example, someone who begins a retirement savings plan in their 20s will see their money grow much more than someone who starts in their 30s or 40s. The key is to start early and let time work in your favor.

2- Boosting Financial Flexibility

Delaying retirement planning means you’ll have to save a larger portion of your income later in life to meet the same goals. This can strain your current finances and limit your ability to enjoy your income now. The ideal scenario is to strike a balance—saving for retirement while still having enough flexibility to enjoy life today. Starting early allows you the freedom to allocate smaller, manageable amounts toward your retirement fund while maintaining financial flexibility.

3- Reducing Dependence on Social Security

Early retirement planning helps reduce reliance on social security benefits in the future. Social security income ensures that beneficiaries, such as low-income families, receive support from the government through the Takaful and Karama Fund. It is often uncertain, especially with the increasing number of people needing assistance. By planning and saving independently, you can create a secure financial foundation for your retirement. Early preparation ensures that you’re not solely dependent on government support and allows you to maintain financial independence.

How to Start Your Retirement Plan?

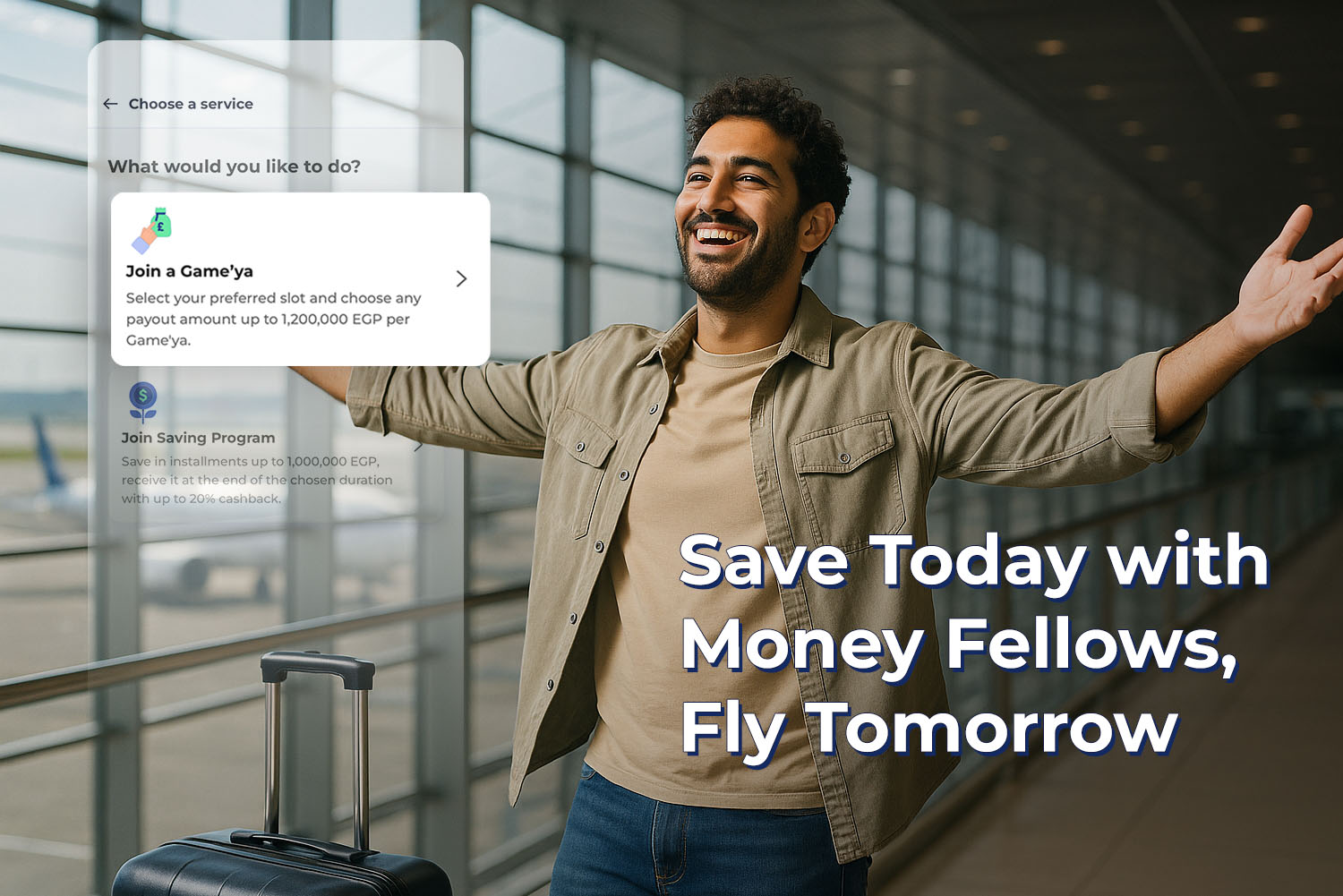

If retirement savings haven’t been a priority for you yet, don’t worry—you’re not alone. Nearly 45% of people aged 25-34 haven’t started saving for retirement either. To begin, explore the savings options available to you. For instance, you can consider opening a retirement savings account at your bank. Such an account allows you to grow your retirement fund over time through accumulated interest. Starting small today will make a significant difference tomorrow.