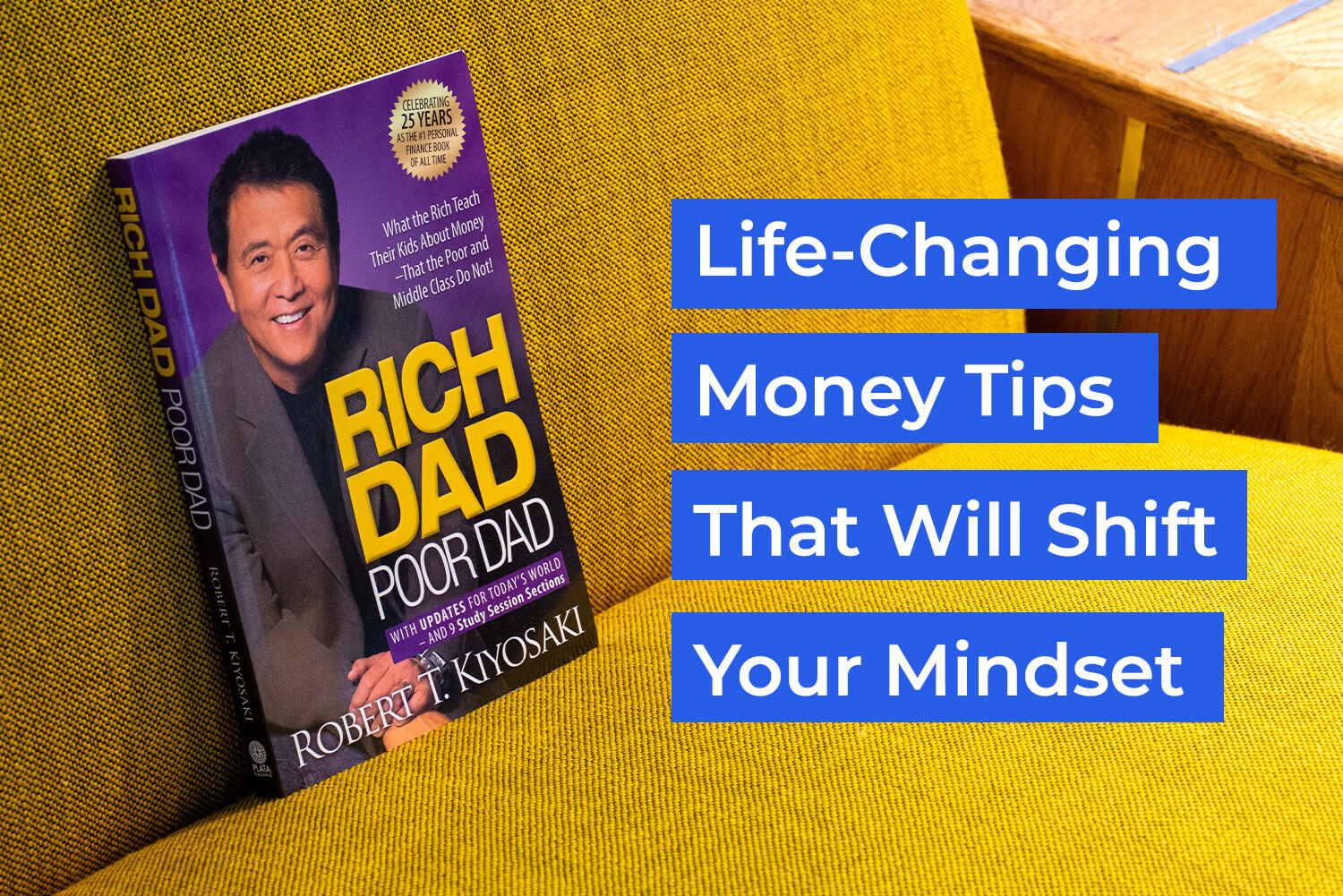

We all search for ways to achieve financial freedom, but few know how to start and keep going the right way. Rich Dad Poor Dad by Robert Kiyosaki is a practical and unique guide that challenges how we view money and investment. This book isn't just about traditional financial advice, it offers real-life lessons on how to think like the wealthy and build assets that secure your future without relying solely on a paycheck.

One of the most famous quotes from the book that sums up its main idea is: "The poor and the middle-class work for money, but the rich make money work for them." This quote alone opens our eyes to the vast difference between the mindset of people who depend on their monthly salary and live paycheck to paycheck, and those who actively seek investment opportunities to build sustainable income and a secure future.

In this article, we’ll take you through the most important lessons from Rich Dad Poor Dad, lessons that will change the way you think about money and your financial future. Let’s dive in!

The Difference Between Rich Dad and Poor Dad

At the beginning of the book, Robert Kiyosaki shares how he had two father figures growing up—one rich, one poor. The rich dad completed his education and earned a doctorate, while the poor dad didn't finish school.

Both worked hard and excelled in their jobs, but in the end, one left a huge fortune worth millions of dollars to his children, while the other left behind debts that had to be paid off.

So, what's the difference between the two?

1. Education: Both emphasized the importance of education, but the rich dad also encouraged learning life lessons, while the poor dad focused mainly on academic education.

2. The Source of Evil: They disagreed on the root cause of evil in the world. The poor dad believed that the love of money was the cause of corruption, while the rich dad believed poverty was the real reason for theft and crime.

3. Attitude Toward Life: When facing new situations, the poor dad would often say, "There’s nothing I can do," while the rich dad would say, "How can I make this happen?"

4. Money and Work: They also had different views on money and work. The poor dad advised playing it safe and avoiding risk, while the rich dad encouraged learning from different situations and managing risks effectively.

8 Powerful Money Lessons from Rich Dad Poor Dad

Lesson 1: The Poor and Middle-Class Work for Money, but the Rich Make Money Work for Them

Robert Kiyosaki's rich dad taught him early on that ordinary people spend their lives working for money, whether it's from a regular job, their own business, or a side hustle. However, the rich understand that money should work for them.

Instead of relying solely on a monthly paycheck, they invest in income-generating assets like stocks, bonds, and real estate.

Tip: Ask yourself: Are you working for money, or is your money working for you?

Lesson 2: It’s Not About How Much You Earn; It’s About How Much You Keep

Many believe that a high income is the secret to wealth. But Kiyosaki emphasizes that it's not about how much you earn, but how much you can save and keep. People with high incomes can still face financial problems if they don’t manage their money well. The key to building wealth is saving and investing wisely.

Tip: Track your spending and find areas where you can cut back and save more.

Lesson 3: Financial Education is Crucial

Kiyosaki points out that you can have a higher education and be successful in your job, but still lack financial literacy. Many people graduate from college without the basic financial skills they need, which can lead to financial struggles even if they're successful in their careers.

A lack of financial education means they're not managing or growing their money effectively.

Tip: Think about the financial concepts you don’t fully understand and seek to learn more about them.