Let’s be honest, most of us wish we could buy what we need easily, in one go, without worrying about credit cards, interest rates, or drowning in debt. We want to reach our goals without the stress of monthly installments or complicated paperwork.

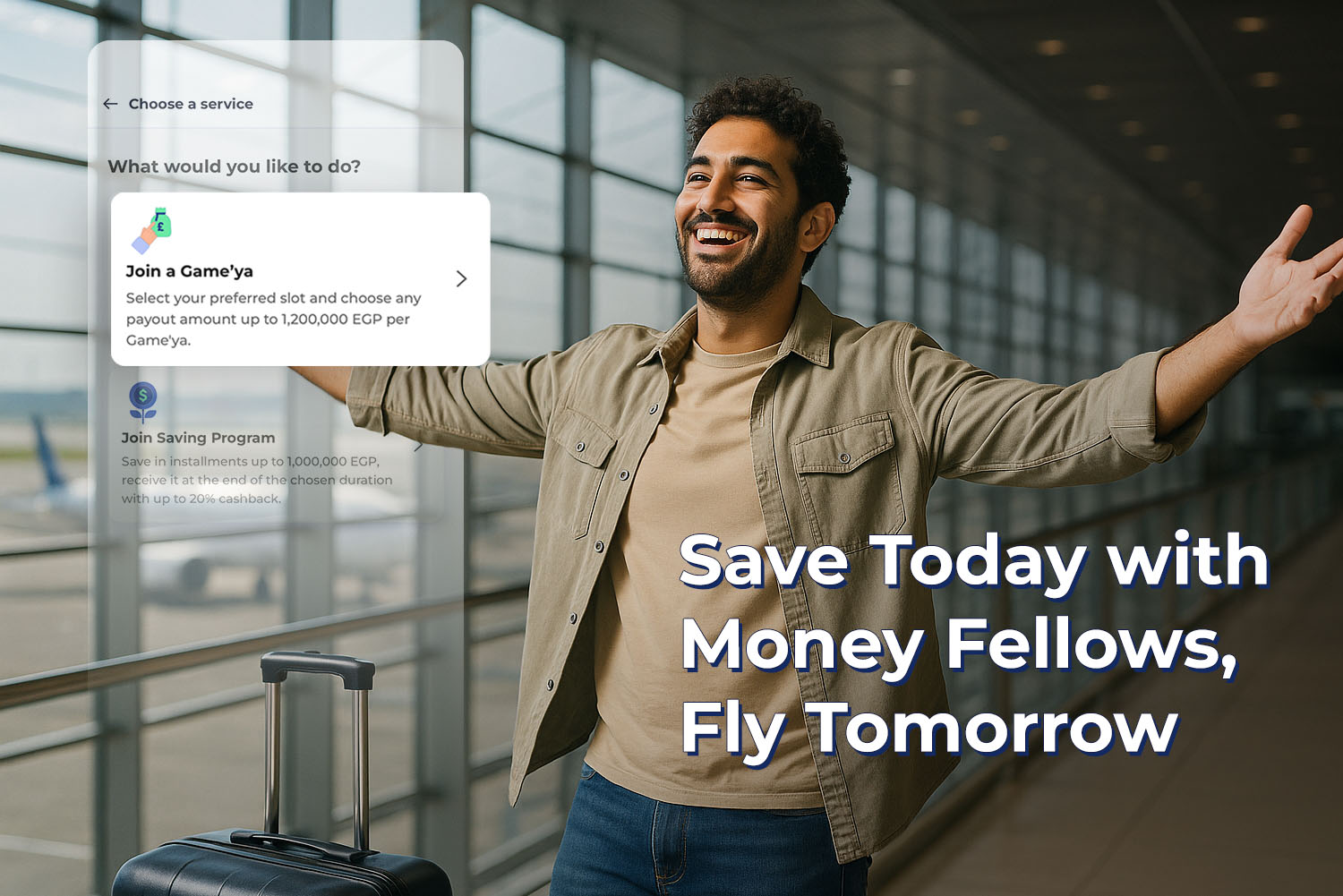

If that sounds like your dream lifestyle, then it’s time to learn about the “Save Now, Buy Later” concept. This simple yet powerful approach helps you save and shop smarter without relying on debt. It’s already gaining momentum across Europe and the US, and now it’s easier than ever to try it in Egypt, especially with digital tools like the Money Fellows app.

Save Now, Buy Later: What is it and how does it work?

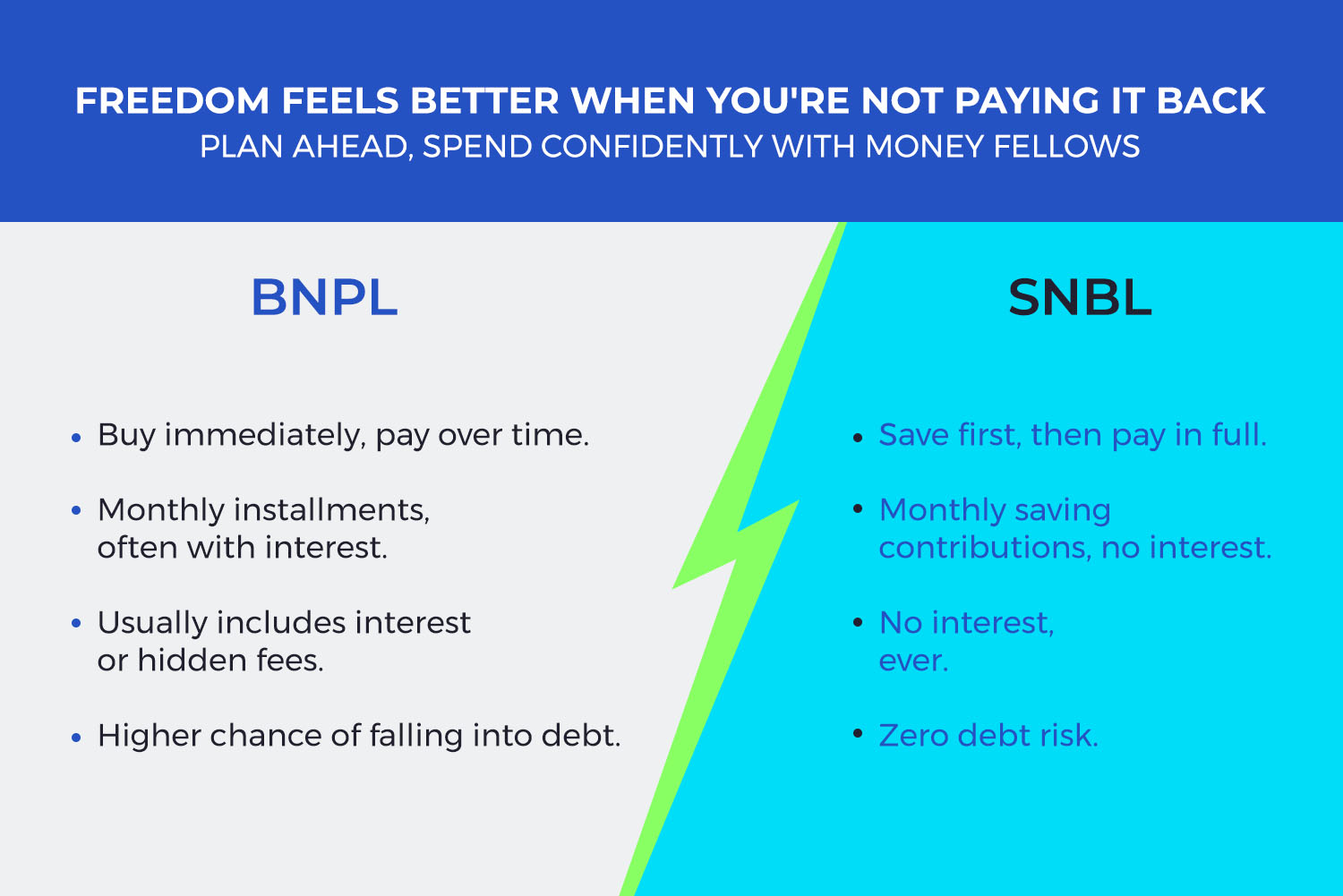

Save Now, Buy Later (SNBL) is the smarter version of “Buy Now, Pay Later” (BNPL). Instead of rushing into purchases and getting tied up in interest or penalties, you set aside a specific amount every month. When you’ve saved enough, you buy what you want, with your own money, interest-free.

It’s very similar to the traditional money circle (game’ya), a system we all know well, but smarter, safer, and fully digital. Rather than taking on debt, you plan ahead, save, and make big purchases with peace of mind.

Why Choose Save Now, Buy Later Over Installment?

At first glance, installment plans may seem convenient. But look closer, and you’ll find they often come with hidden costs:

- High interest rates and fees: sometimes over 30%

- Strict monthly obligations: missing a payment can mean big penalties

- Complicated requirements: needing credit cards, proof of income, or bank approvals

- Constant financial pressure: feeling like you're always in debt

On the other hand, Save Now, Buy Later gives you full control over your money:

- Save at your own pace, with no pressure

- Make purchases debt-free, without the burden of future payments

- Learn better budgeting habits and financial planning

- Avoid interest, late fees, and overspending

Download Money Fellows app now and start saving money with hassle-free money circles (game’yat). Reach your goals on your terms, anytime, anywhere.