In today’s world, where prices are constantly rising and inflation is hitting everyone’s budget, it’s only natural to look for smart financial solutions that help you get what you need without draining your savings or drowning in debt.

We’ve all been there: you want to buy something important or even a luxury you’ve been eyeing for a while, but you don’t want to wipe out your savings or get stuck in long, stressful installment plans with high interest rates from Buy Now Pay Later (BNPL) services or credit cards. Now, there’s a smarter, faster-growing solution that’s gaining popularity worldwide: Save Now, Buy Later (SNBL).

Read more about SNBL from this article: Save Now, Buy Later: The Smarter Way to Pay

This method doesn’t just let you buy with peace of mind; it helps you control your spending, build healthy saving habits, and shop without interest, debt, or financial stress. In this article, we’ll break down the difference between SNBL and BNPL and show how Money Fellows makes SNBL simple, secure, and achievable for everyone.

What is Save Now, Buy Later (SNBL)?

Simply put, Save Now, Buy Later means setting aside money until you’ve saved the full amount for your purchase, then paying for it in cash.

The concept isn’t new; in fact, many of us are used to saving up for big purchases without borrowing. But SNBL makes it easier to commit to your savings goal, so you can get what you need without debt, faster and smarter—especially important in today’s high-inflation environment.

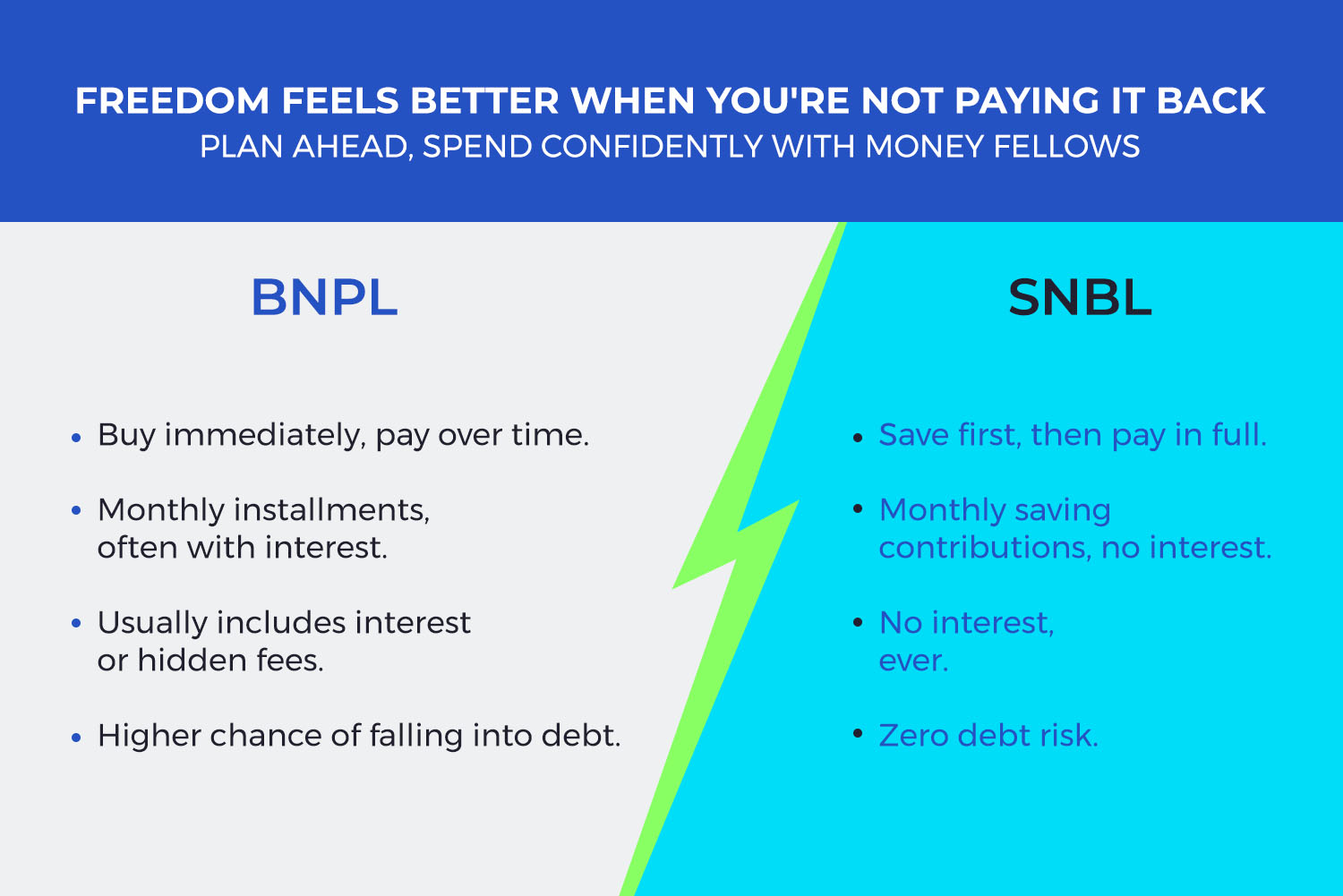

SNBL vs BNPL: The Key Differences

| Feature | Save Now, Buy Later (SNBL) | Buy Now, Pay Later (BNPL) |

|---|---|---|

| When you buy | Save first, then pay in full. | Buy immediately, pay over time. |

| Payment method | Monthly saving contributions, no interest. | Monthly installments, often with interest. |

| Interest fees | No interest, ever. | Usually includes interest or hidden fees. |

| Debt risk | Zero debt risk. | Higher chance of falling into debt. |

While BNPL feels convenient at first, it can lead to financial instability and long-term debt. SNBL, on the other hand, builds your savings discipline, ensures you shop from a position of strength, and keeps your finances stable.

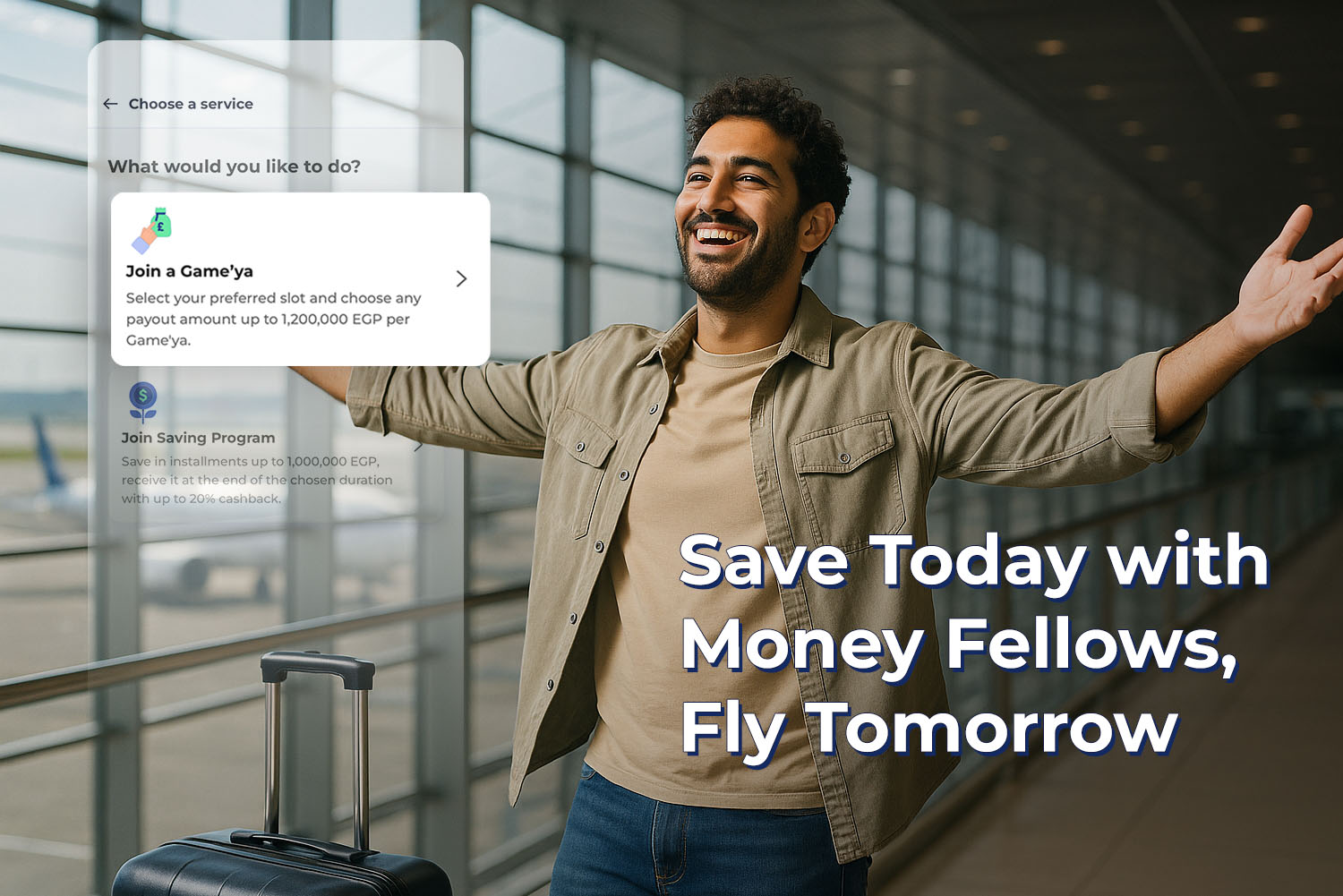

Download Money Fellows app and start your SNBL journey today.