Does your salary disappear before the middle of the month? Are you spending a lot without knowing where your money is going? Or maybe you want to start saving but don’t know how to begin? Don’t worry—you’re not alone! Managing money has become a major challenge these days, especially with the rising cost of living.

But a simple and effective method can change how you handle your money: The 50/30/20 budgeting rule. You don’t need complicated calculations or fancy tools. All it takes is to divide your income into three clear categories—each with a purpose that helps bring structure to your financial life.

Let’s explore how this method can help you live more comfortably, create a realistic monthly budget, and reach your financial goals without feeling overwhelmed.

What Is the 50/30/20 Rule?

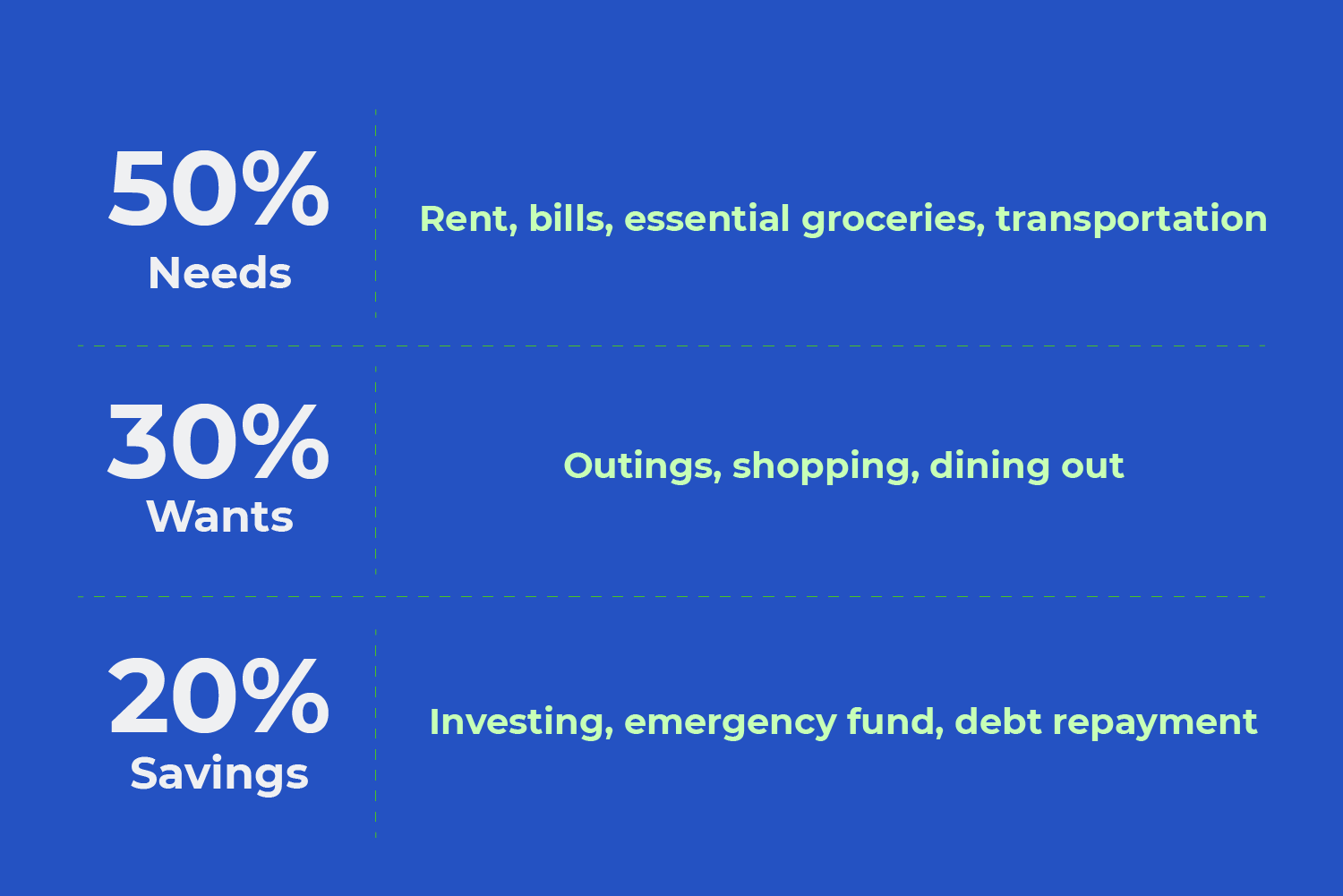

The 50/30/20 rule is a straightforward budgeting method that splits your monthly income into three main categories:

- Needs (50%): Rent, utility bills, groceries, transportation, and other essentials you can’t live without.

- Wants (30%): Dining out, entertainment, hobbies, and anything you enjoy doing in your free time.

- Savings & Debt Repayment (20%): Building an emergency fund, saving for future goals, or paying off loans faster.

This popular rule was made famous by U.S. Senator Elizabeth Warren and has helped thousands take control of their personal finances. It’s simple, realistic, and easy to maintain over the long term.

If you’re looking for a beginner-friendly budgeting plan that works, the 50/30/20 rule is a great place to start.