With the widespread availability of credit cards and financial facilities, it's become common to pay for purchases—even small ones—using a credit card. While paying with a credit card can be incredibly convenient and can even save you in certain situations, using credit cards can have both good and bad reasons.

In a world where many people see credit cards as a quick solution for everything, the truth is they can also lead to serious financial issues. Credit cards give us the illusion of always having money on hand, but using them irresponsibly can lead to debt accumulation and mounting interest, often without realizing it.

In this article, we'll explore some important reasons why you should think twice before applying for and using a credit card, especially if you're just starting on your financial journey.

What Are Credit Cards?

A credit card is a financial tool used instead of cash or a debit card to make purchases. When you apply for a credit card, the issuing bank sets a specific credit limit for you. When you buy something using your credit card, the money is deducted from this credit limit, and you're required to repay it within a specified period.

If you decide to use a credit card, it's advisable to pay off the entire balance before the due date to avoid paying interest on the outstanding amount. Credit card bills usually come with a minimum payment requirement each month.

What’s the Difference Between Credit Cards and Debit Cards?

A debit card is directly linked to your bank account, meaning when you purchase something, the funds are deducted from your account almost immediately. However, with a credit card, the amount spent is deducted from your available credit limit, and you're expected to repay it later.

How Safe is Using Credit Cards?

This largely depends on your ability to repay what you owe. A good way to evaluate your credit card safety is by considering your "credit utilization ratio," which is the amount of credit you're using at any given time compared to your total credit limit. Constantly maxing out your credit card can put you on a path to financial trouble.

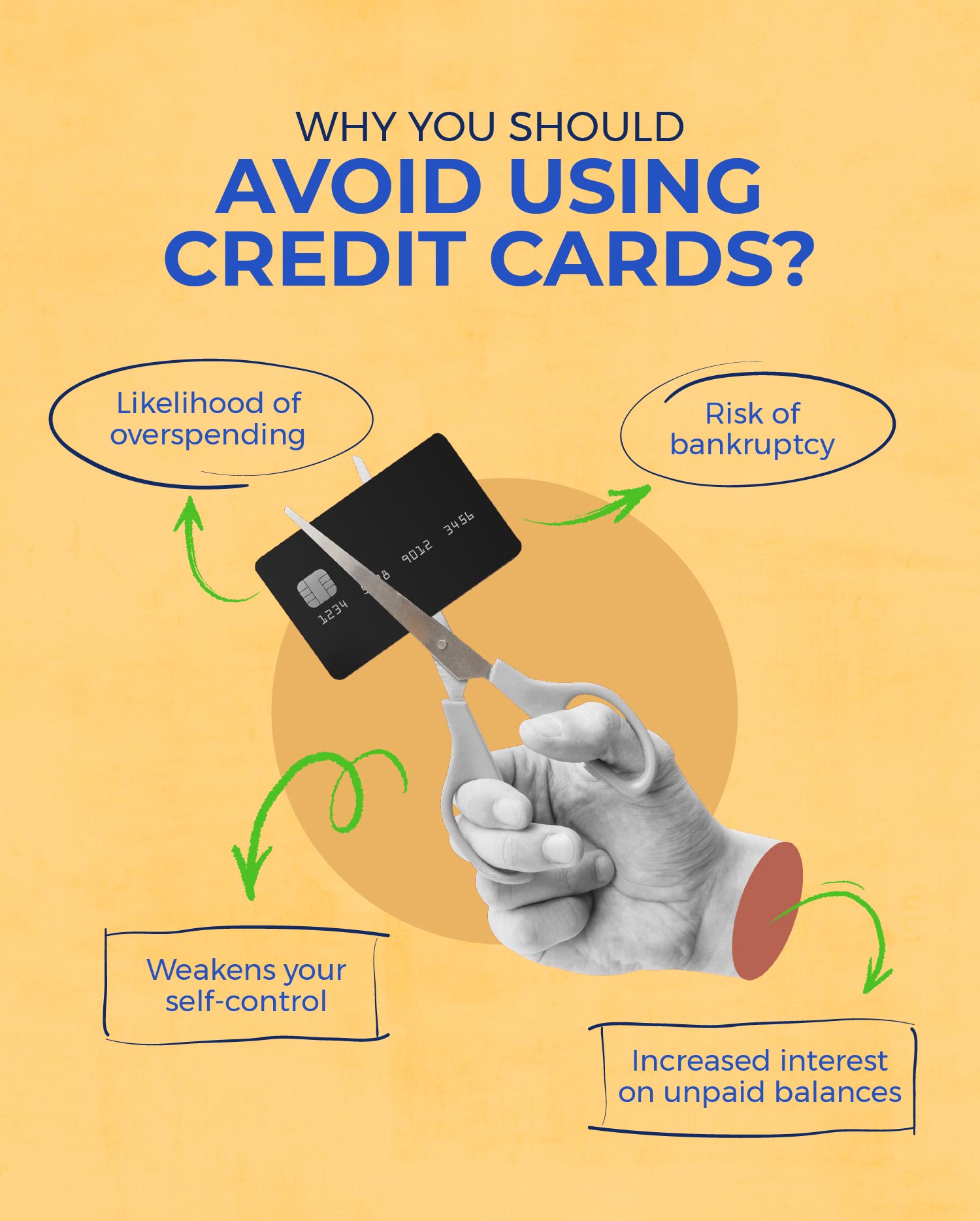

9 Reasons to Say No to Using Credit Cards

Here are 9 critical reasons to reconsider using a credit card. These might protect you from falling into the debt trap and facing long-term financial challenges.

1. Weakens Your Self-Control

If you can't control your desire to make purchases, you could lose your financial security over time. Worse still, impulsive buying can negatively affect other areas of your life, such as your self-confidence, and could lead to unhealthy behaviors like shopping addiction.

While self-control isn't always easy, it's crucial for achieving bigger financial goals like buying a house or saving for the future.

2. A Sign of No Monthly Budget

Using a credit card often means you're living without a monthly budget. Without a budget, it's easy to forget you're paying for small things like coffee or a new book, but all these small purchases add up by the end of the month, leading to financial stress.

Creating a budget is simpler than you might think. You just need to list your monthly income and expenses. What’s left over will guide how much you can spend without getting into trouble.